Implementing Real Time Cloud Mapping

Mapping out your cloud architecture automatically is what Hava does best. Here's how you can implement a cloud mapping strategy in your business.

Who leads the cloud market in 2024, and what are their shares? This analysis cuts through the technical jargon to bring you a clear snapshot of the current cloud market share. We’ll evaluate the standing of leaders like AWS, Microsoft Azure, and Google Cloud, disclose notable trends, and discuss the industry’s trajectory.

Amazon Web Services (AWS) maintains the highest market share at 32%, followed by Microsoft Azure (23%) and Google Cloud (10%), while Alibaba Cloud and Tencent Cloud are notable players in the Asia-Pacific market.

Cloud services are extensively categorized into IaaS, PaaS, and SaaS, with AWS leading the IaaS sector, whereas PaaS and SaaS markets show significant growth with diverse key players and a combined market value projected in the billions.

Cloud market dynamics are shaped by regional adoption, with North America leading, rapid growth in Asia Pacific, and steady expansion in Europe, while security measures and emerging technologies like AI, ML, edge, and serverless computing are critical to future market evolution.

In the cloud computing market, three titans lead the charge – Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform. AWS, with a mighty 32% market share, proves that being an early bird does indeed get the worm. Not too far behind, Azure and Google Cloud are relentless in their pursuit, with Google Cloud’s market share currently at 10% and Azure commanding 23% of the market respectively.

The cloud infrastructure services market, however, reveals a different story. Among light cloud users, Azure slightly edges out AWS, while emerging contenders like Alibaba Cloud and Tencent Cloud are gaining momentum, particularly in the Asia Pacific region.

AWS, the brainchild of retail giant Amazon.com, dominates the global cloud market with a whopping 32% share. The key to AWS’s success lies in:

Its early market entry

Robust technology

Diverse service offerings

Competitive pricing

Exceptional customer support

AWS has effectively cornered the market and established itself as the cloud provider to beat, thanks to its rapid expansion and scale, backed by a well-resourced parent company.

Hot on AWS’s trail are Microsoft Azure and Google Cloud, holding 23% and 10% of the global cloud market respectively. Microsoft Azure, with its vast range of over 600 cloud services, has especially been successful among light and moderate cloud users, claiming a slight lead over AWS in the global cloud services market.

Meanwhile, Google Cloud is carving out a niche for itself in the global cloud market, continuing to grow at an impressive rate. Both Azure and Google Cloud have been relentless in their pursuit to dethrone AWS, making the race for the cloud crown an exciting one.

While the spotlight is on AWS, Azure, and Google Cloud, emerging contenders like Alibaba Cloud and Tencent Cloud are making waves, particularly in the Asia-Pacific region. Alibaba Cloud, with a 7.7% share of the public cloud market, ranks third globally in the IaaS sector and is the top-ranked in the Asia-Pacific region. Tencent Cloud, on the other hand, commands approximately 25% of China’s public cloud market and is experiencing steady growth.

These contenders are being propelled to the forefront of the global cloud market through rapid expansion, advanced computing capabilities, and strategic global expansion plans.

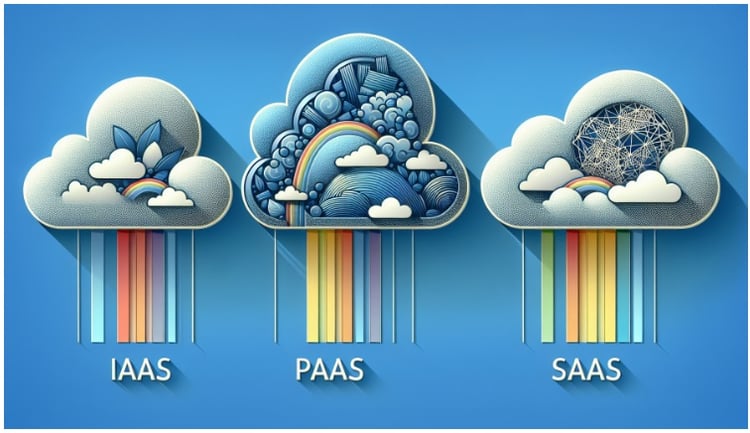

The cloud market involves not only who’s leading the pack, but also how the services are modeled. The three primary service models shaping the cloud landscape are:

Infrastructure as a Service (IaaS): provides on-demand access to computing resources

Platform as a Service (PaaS): offers a comprehensive platform for application development

Software as a Service (SaaS): delivers applications via the internet

Each of these service models, with their unique offerings, contribute to the backbone of the cloud market, and notably, AWS is leading the IaaS sector.

AWS is the undisputed leader in the IaaS segment, with Microsoft Azure, Alibaba, Google, and IBM following closely behind.

AWS’s dominance can be attributed to its:

extensive range of services

cost-effectiveness

scalability

flexibility

enhanced operational efficiency

Given AWS’s compelling offerings, it’s no surprise that they command the largest market share in the IaaS sector.

The PaaS market is a diverse landscape featuring a mix of mega-vendors and specialized providers. Some of the top players in the market include:

Microsoft Azure

Amazon

Oracle

IBM

These companies offer a wide range of PaaS solutions to meet the needs of businesses of all sizes.

An impressive projected five-year compound annual growth rate (CAGR) of 29.9% for PaaS spending indicates a significant expansion in the PaaS market.

SaaS is another crucial pillar of the cloud market. It eliminates the need for customers to install, manage, and update software on their devices, making it an attractive option for many businesses. With a $208 billion market share, SaaS providers like Salesforce and Adobe hold significant market influence.

With approximately 20% of total enterprise software spending, the SaaS market further demonstrates its considerable influence.

The cloud market isn’t just a global phenomenon; it’s also a regional one. North America and Europe are currently leading the charge in cloud adoption, with Asia Pacific rapidly closing the gap.

Top priorities in Europe include migration to the cloud, optimizing existing cloud use, and progressing on a cloud-first strategy. While the cloud usage in Europe is slightly below the global average, a significant 65% of European organizations report higher cloud usage than planned.

North America, being the birthplace of many cloud giants, leads the global cloud market with a 41% share. The early adoption of advanced technologies like AI and ML has significantly contributed to the region’s cloud market growth. The market dominance is further bolstered by the strong presence of major cloud providers like AWS, Microsoft Azure, and Premier Enterprise Media Services.

The Asia Pacific region is experiencing a cloud computing surge. The market size reached $32.5 billion in 2022 and is expected to contribute over $200 billion to the global cloud computing market by 2024.

The region’s rapid growth is driven by:

The ongoing shift towards digital business models

The significant market size and growth potential

The presence of major players like AWS, Azure, and Google Cloud.

While North America and Asia-Pacific are at the forefront of cloud adoption, Europe is not far behind. Despite strict data privacy and security regulations, Europe is experiencing steady growth in cloud adoption. Countries like:

Sweden

Finland

Netherlands

Denmark

In a recent study by Synergy Research Group, it was found that certain industries have observed the highest rates of cloud adoption.

Deutsche Telekom, a European giant, holds the largest market share in the region, demonstrating Europe’s growing prominence in the cloud market.

Cloud services represent not just a technological advancement, but also a business revolution. From startups to tech giants, companies are leveraging cloud services to enhance their operations and drive digital transformation. A staggering 98% of organizations utilize the cloud in various capacities, and 96% depend on at least one public cloud.

Corporate cloud migration, hybrid cloud strategies, and SMB cloud adoption are all gaining momentum, reshaping business models and the way we work.

For businesses seeking agility and cost efficiency, cloud migration has become the new norm. Approximately 71% of enterprises encounter difficulties in transferring data to the cloud, reflecting the complexity of cloud migration. However, the benefits such as decreased total cost of ownership, enhanced flexibility, and improved performance make the migration worthwhile.

Industries like banking, financial services, education, healthcare, entertainment, and retail are leading the charge in corporate cloud migration.

Businesses in the cloud world are diversifying their investments, not putting all their eggs in one basket. Instead, they prefer a hybrid approach. A staggering 82% of IT leaders have embraced the hybrid cloud, a combination of public and private cloud solutions. Furthermore, 92% of businesses utilize more than two public cloud providers, demonstrating the widespread adoption of multi-cloud strategies.

This approach helps businesses enhance security, achieve agility, and leverage the innovative services provided by various cloud providers, including their chosen cloud service provider.

Driven by the need for cost-effective and scalable solutions, small and medium businesses (SMBs) are embracing cloud adoption and spending. Roughly 78% of SMBs are utilizing cloud services, and 39% of them are spending up to $600,000 annually on public cloud services.

From communications to financial tools, SMBs are leveraging a wide range of cloud services to enhance their business operations.

The business of cloud involves not only technology, but also financial considerations. Global cloud spending has experienced a 34% year-over-year growth, with estimates suggesting it will surpass $599 billion in 2023. From public cloud services to enterprise IT budgets, money is flowing into the cloud market like never before, indicating the financial significance of cloud computing in the business world.

Tracking where the money flows in the cloud market reveals fascinating insights. Here are some key statistics:

The global end-user spending on public clouds is expected to rise to $678.8 billion in 2024, indicating a surge in cloud adoption.

Businesses are designating approximately 47% of their IT budgets to public cloud services.

This percentage is anticipated to rise in 2023.

The growth in cloud spending is particularly high in sectors such as Software and Information Services.

Increased cloud adoption is benefiting cloud providers significantly. Here are some examples:

AWS recorded a revenue of $23.06 billion

Google Cloud reported a revenue of $8.4 billion

Microsoft Azure experienced a growth of 29% in the third quarter.

The revenue growth can be attributed to:

The growing adoption of Big Data

Artificial Intelligence (AI)

Machine Learning (ML)

The increasing need for scalable, secure, reliable, and cost-effective cloud resources.

Cloud spending does come with its own set of cost concerns. Businesses employ a range of strategies to manage cloud costs, such as:

Proactively rightsizing compute resources

Monitoring and correcting cost anomalies

Setting budgets

Establishing cloud cost governance.

They also utilize various tools like Anodot, AppDynamics, and AWS CloudWatch to oversee and manage cloud spending effectively.

The cloud market involves:

The big players and their market shares

The technological transformations that shape the industry

AI and ML integration in cloud services, which is driving innovation and enhancing the capabilities of cloud offerings.

Emerging technologies like edge computing and serverless computing are also playing a crucial role in shaping the cloud market landscape.

AI and ML are revolutionizing cloud services. They are automating processes like data analysis, data management, and decision-making, enhancing the efficiency of cloud workloads. Cloud providers are also offering AI services for applications like computer vision, natural language processing, speech recognition, and recommendation systems.

The integration of AI and ML in cloud services is creating new experiences and capabilities, driving the evolution of the cloud market.

Leading cloud providers continue to innovate, introducing new features and services to maintain their competitive edge. Some recent updates from cloud providers include:

Microsoft Azure has introduced new app services, compute services, and data and networking services.

Google Cloud has launched new service extensions for Cloud Load Balancers and unveiled new products such as generative AI, cloud infrastructure services, and security features.

Alibaba Cloud has introduced the AI model Tongyi Qianwen.

Tencent Cloud has revealed a range of new cloud technology services.

These updates demonstrate the ongoing commitment of cloud providers to enhance their offerings and provide cutting-edge solutions to their customers.

Security in the cloud is a top priority for businesses. With data breaches and cyber threats on the rise, businesses are investing heavily in securing their cloud deployments. Leading cloud providers have implemented robust security measures to protect their customers’ data and applications, including:

Encryption of data at rest and in transit

Multi-factor authentication for user access

Regular security audits and vulnerability assessments

Network segmentation and isolation

Intrusion detection and prevention systems

Incident response and recovery plans

These security measures help boost customer trust and influence market share.

Top cloud providers have implemented robust security measures to protect their customers’ data and applications. Microsoft Azure employs measures like ensuring data confidentiality and integrity, utilizing encryption, identity, and authorization policies. Google Cloud uses stringent data protection strategies, including trust principles and encryption of data at rest.

Alibaba and Tencent Cloud offer comprehensive security services, including threat detection, DDoS defense, and real-time monitoring.

Cloud security plays a crucial role in determining market share. Businesses prioritize data protection and compliance, leading them to choose cloud service providers with strong security protocols. A provider’s security reputation can significantly impact their market share.

A positive security reputation can draw in more customers, while a negative security reputation can result in diminished trust and customers choosing competitors.

Looking at the future path of the cloud market, the cloud hosting market is set to continue its rapid growth, with emerging technologies like edge and serverless computing promising to revolutionize the industry. Driven by the emergence of new service providers and advancements in technologies like AI, ML, and IoT, the cloud market is expected to reach USD 2,432.87 billion by 2023.

It’s a complex task to forecast market share shifts in the cloud industry. With a compound annual growth rate of 18.86% expected in the upcoming years, the cloud computing market is set for significant expansion. The market shares between IaaS, PaaS, and SaaS are also expected to shift, with IaaS projected to experience the highest end-user spending growth.

As the market expands and develops, we can anticipate fluctuations in the market share of the leading cloud providers.

Emerging technologies like edge computing and serverless computing are set to shape the cloud market landscape in the coming years. Cloud computing services, such as edge computing, allow organizations to enhance the efficiency of their cloud infrastructure by transferring specific workloads to edge devices, while serverless computing offers on-demand access to resources.

Additional technologies that are expected to impact the cloud market include containers, microservices, DevOps, Internet of Things (IoT), and AI-as-a-service.

If you are building on AWS, Azure or GCP or any combination of the three, you should probably check out Hava. Not only will it fully automate your cloud architecture diagrams, retain version history and allow you to compare any two historical infrastructure diagrams, it will also monitor your architecture and tell you when something changes.

In conclusion, the cloud computing market is a dynamic and rapidly evolving landscape. With major players like AWS, Azure, and Google Cloud leading the charge, emerging contenders like Alibaba Cloud and Tencent Cloud are gaining momentum. The integration of AI and ML is driving innovation and enhancing the capabilities of cloud offerings. As the market continues to expand, businesses are increasingly prioritizing cloud security and cost management. The future of the cloud market is bright, with technology advancements promising to revolutionize the industry. Stay tuned to the cloud market dynamics, as the winds of change are certain to bring exciting developments.

AWS has the biggest market share in cloud, with 32% of the market, followed by Microsoft's Azure Cloud and Google Cloud Platform (GCP). Alibaba Cloud is in the top three as well, with 9.5% market share.

The top 3 cloud service providers are Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP), which collectively dominate 66% of the global cloud infrastructure market.

In 2023, AWS maintains its leading position with 31% market share, continuing its dominance in the cloud infrastructure services market. This reflects its stability and strong market presence.

The primary service models in the cloud market are Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), each serving different needs for businesses.

The primary trend in corporate cloud migration is the transition to the cloud to achieve a decrease in total cost of ownership (TCO), enhanced flexibility for employees, and reduced IT expenses. Many companies are moving to the cloud for these benefits.

Building on the big 3? Why not take Hava for a test drive and see what you really have running in your cloud accounts.

Mapping out your cloud architecture automatically is what Hava does best. Here's how you can implement a cloud mapping strategy in your business.

Cloud architecture diagrams are an essential tool for clear communication between engineers and management. Retaining diagram versions amplifies...

Master cloud diagramming with our in-depth guide on visualization best practices. Explore how Hava.io automates and elevates your cloud architecture...